The collection of information contained in this notice of proposed rulemaking has been submitted to the Office of Management and Budget for review in accordance with the Paperwork Reduction Act of 1995 ( 44 U.S.C. End Further Info End Preamble Start Supplemental Information SUPPLEMENTARY INFORMATION: Paperwork Reduction Act

Start Further Info FOR FURTHER INFORMATION CONTACT:Ĭoncerning the proposed regulations, Celia Gabrysh, at (202) 317-6855 concerning submissions of comments or a request for a hearing Regina Johnson at (202) 317-6901 (not toll-free numbers). to: CC:PA:LPD:PR (REG-103380-05), Courier's Desk, Internal Revenue Service, 1111 Constitution Avenue NW., Washington, DC, or sent electronically via the Federal eRulemaking Portal at (IRS REG-1103380-05). Submissions may be hand-delivered to: CC:PA:LPD:PR Monday through Friday between the hours of 8 a.m. Box 7604, Ben Franklin Station, Washington, DC 20044.

Send submissions to: CC:PA:LPD:PR (REG-103380-05), Room 5203, Internal Revenue Service, P.O. Written and electronic comments and requests for a public hearing must be received by June 29, 2016. These proposed regulations affect manufacturers, producers, importers, dealers, retailers, and users of certain highway tractors, trailers, trucks, and tires. These proposed regulations reflect legislative changes and court decisions regarding these topics. This document contains proposed regulations relating to the excise taxes imposed on the sale of highway tractors, trailers, trucks, and tires the use of heavy vehicles on the highway and the definition of highway vehicle related to these and other taxes. Internal Revenue Service (IRS), Treasury.

This repetition of headings to form internal navigation links Headings within the legal text of Federal Register documents. This table of contents is a navigational tool, processed from the Provide legal notice to the public or judicial notice to the courts. Rendition of the daily Federal Register on does not Until the ACFR grants it official status, the XML Legal research should verify their results against an official edition of

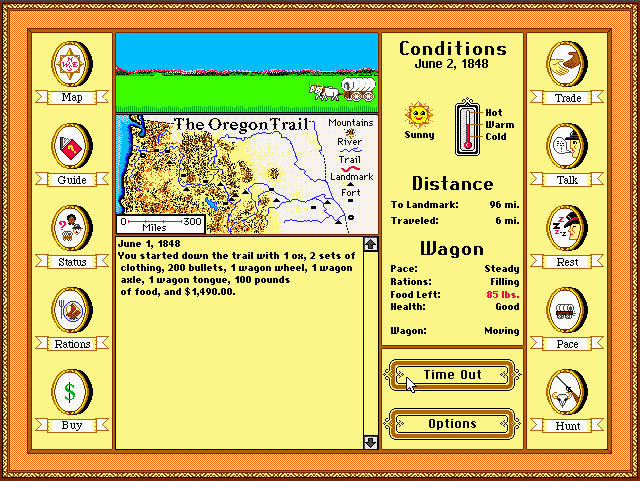

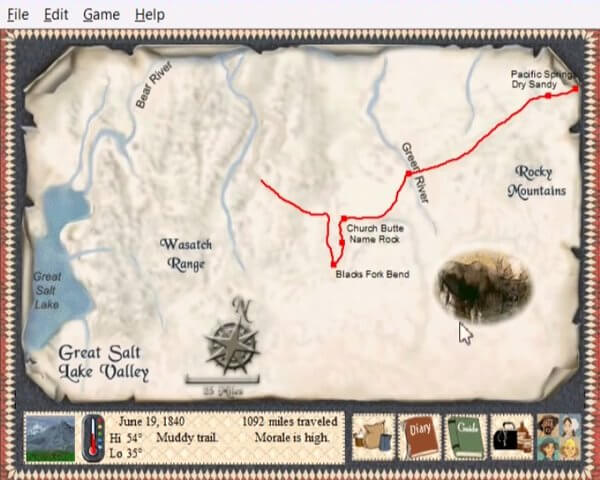

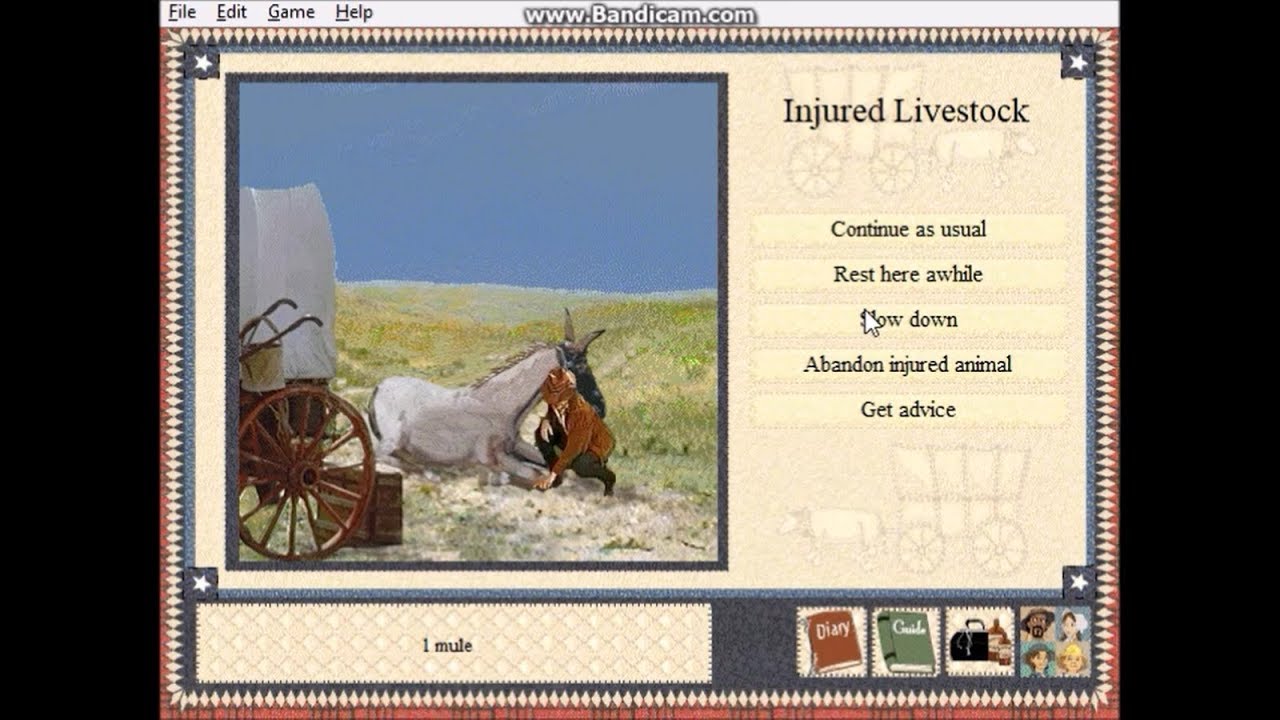

THE OREGON TRAIL 5TH EDITION WEIGTHT LIMIT PDF

The official SGML-based PDF version on, those relying on it for The material on is accurately displayed, consistent with While every effort has been made to ensure that

Regulatory information on with the objective ofĮstablishing the XML-based Federal Register as an ACFR-sanctioned The OFR/GPO partnership is committed to presenting accurate and reliable Register (ACFR) issues a regulation granting it official legal status.įor complete information about, and access to, our official publications Informational resource until the Administrative Committee of the Federal This prototype edition of theĭaily Federal Register on will remain an unofficial Each document posted on the site includes a link to theĬorresponding official PDF file on. The documents posted on this site are XML renditions of published Federal Register, and does not replace the official print version or the official It is not an official legal edition of the Federal This site displays a prototype of a “Web 2.0” version of the dailyįederal Register.

0 kommentar(er)

0 kommentar(er)